Continue Reading

October 5, 2009

June 15, 2009

Shorting is common sense now !!

- US markets ended Lower

- SGX Nifty down

- Indian Markets were up from so many weeks and were looking tired and closed lower in last 2 days .

What does that mean ? SELL on small upbounce with tight stop losses . No great analysis needed here . Just short !! .

Continue Reading

- SGX Nifty down

- Indian Markets were up from so many weeks and were looking tired and closed lower in last 2 days .

What does that mean ? SELL on small upbounce with tight stop losses . No great analysis needed here . Just short !! .

Continue Reading

June 14, 2009

Wait for BUY , Sell on pullbacks

The Pivot for nifty today is around 4535 . SGX Nifty is trading about those levels and India Markets are also expected to go lower today as other Asian markets are also trading lower .

Nifty seems to be tired now and it would be a healthy for it , if it corrects itself now , otherwise it will become more vulnerable for a big and sudden fall later .

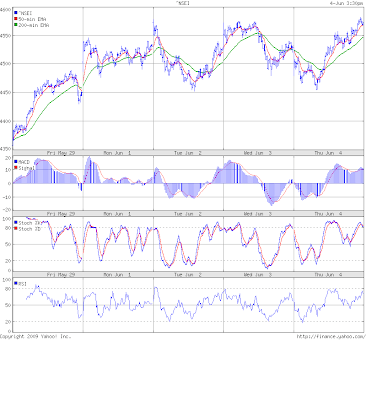

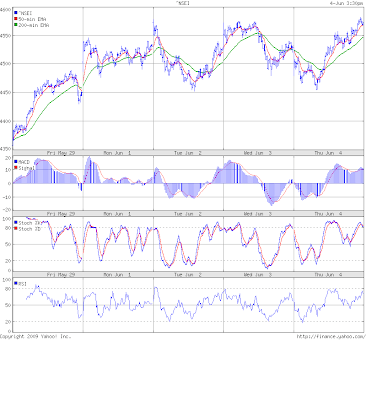

If you see 9 months chart , ADX seems to be falling now from many days indicating that its tired now and the momentum is declining .

If you are looking for buying , wait for short term . If you want to short , do it on pullback on intra-day .

Continue Reading

Nifty seems to be tired now and it would be a healthy for it , if it corrects itself now , otherwise it will become more vulnerable for a big and sudden fall later .

If you see 9 months chart , ADX seems to be falling now from many days indicating that its tired now and the momentum is declining .

If you are looking for buying , wait for short term . If you want to short , do it on pullback on intra-day .

Continue Reading

June 4, 2009

Markets near strong resistance , Call for Friday June 5

Markets went down today in the start and then bouced back . A small positive divergence was visible on MACD and RSI . It was worth taking a long shot because the prices were near the low of 2 days and hence a bounce back was expected .

Markets rallied then and didnt stop .. It closed near days high and at very important and strong resistance levels of 4570 levels . I am personally not very bullish , but i will change my mind if markets show me that i am wrong .

Markets rallied then and didnt stop .. It closed near days high and at very important and strong resistance levels of 4570 levels . I am personally not very bullish , but i will change my mind if markets show me that i am wrong .

Better to make long positions only if markets move above 4600 and buy on a small 20-25 points dip on intra-day level . Go short if markets start moving down from here with tight stop losses .

Continue Reading

Markets rallied then and didnt stop .. It closed near days high and at very important and strong resistance levels of 4570 levels . I am personally not very bullish , but i will change my mind if markets show me that i am wrong .

Markets rallied then and didnt stop .. It closed near days high and at very important and strong resistance levels of 4570 levels . I am personally not very bullish , but i will change my mind if markets show me that i am wrong .Better to make long positions only if markets move above 4600 and buy on a small 20-25 points dip on intra-day level . Go short if markets start moving down from here with tight stop losses .

Continue Reading

June 2, 2009

Market update 3rd June Wednesday

US markets are up marginally and SGX nifty is also up . we are near very important resistance level now . Momentum Can take this rally to 5000 levels or the correction can take it to 4000 levels again where it can again be a good buy for long term investors . NIFTY PE stands at 21 which is the main discouragement for long term investors

S2 4385.85

S1 4455.5

Pivot *4520.95*

R1 4590.55

R2 4656

What can be done now ?

I believe that trades should be taken on trend basis now , dont fall in that trap of catching the top of bottom and get maximum out of markets , better to go with it .

Buy when 50 EMA crosses above 200 EMA and sell otherwise .

Continue Reading

S2 4385.85

S1 4455.5

Pivot *4520.95*

R1 4590.55

R2 4656

What can be done now ?

I believe that trades should be taken on trend basis now , dont fall in that trap of catching the top of bottom and get maximum out of markets , better to go with it .

Buy when 50 EMA crosses above 200 EMA and sell otherwise .

Continue Reading

May 27, 2009

Update for Thursday , May 28

Markets closed just above important resistance levels of 4270 . Tomorrow is expiry day and bias is on upside now .

- US markets are trading Flat .

- GM is close to bankruptcy .

I expect market to open flat tomorrow and it might start its upmove towards R1 levels of 4337 .

I expect market to open flat to low and then start its upmove high. I am planning to avoid trading tomorrow . People who want to trade should buy at dips only and that too for June series . Last day of expiry can be very risky .

Continue Reading

- US markets are trading Flat .

- GM is close to bankruptcy .

I expect market to open flat tomorrow and it might start its upmove towards R1 levels of 4337 .

R2 4,397

R1 4,337

Pivot 4,226

S1 4,165

S2 4,055

I expect market to open flat to low and then start its upmove high. I am planning to avoid trading tomorrow . People who want to trade should buy at dips only and that too for June series . Last day of expiry can be very risky .

Continue Reading

May 25, 2009

DOJI again creating confusion for market , better to trade light this week

wooo ....

This is a strange day :) .. The pivot for tomm is same as close today :) . Nifty is making some DOJI these days inclding one today .

If you see 6 months charts of nifty , ADX is declining suggesting the weakness in trend , Its not a signal to SELL , but just to be cautious :) .

Better to trade light now !! , Dont take short positions just now , but wait for the moment and dont get caught in the madness of panic buying , This time if markets move fast and break 5000 mark , It would be wise to then wait and look for shorting opportunities .

At the time of writing , US markets are flat with little down moves . Markets are too confused all over the world on direction

Important Levels for Tomorrow

R2 4,303

R1 4,270

Pivot 4,238

S1 4,205

S2 4,173

Strategy

- Better to trade light tomm (actually whole week because of expiry) .

- Better to long positions based on oscilators signal (buy when RSI and Stocastics dip to oversold).

- BUY only above Pivot .

Disclamer : I hold a 4100 CA bought at 140 and it closed at 152 today . Looking to carry it further if its in profit , else i will sell it once Nifty hits below 4200 .

Continue Reading

This is a strange day :) .. The pivot for tomm is same as close today :) . Nifty is making some DOJI these days inclding one today .

If you see 6 months charts of nifty , ADX is declining suggesting the weakness in trend , Its not a signal to SELL , but just to be cautious :) .

Better to trade light now !! , Dont take short positions just now , but wait for the moment and dont get caught in the madness of panic buying , This time if markets move fast and break 5000 mark , It would be wise to then wait and look for shorting opportunities .

At the time of writing , US markets are flat with little down moves . Markets are too confused all over the world on direction

Important Levels for Tomorrow

R2 4,303

R1 4,270

Pivot 4,238

S1 4,205

S2 4,173

Strategy

- Better to trade light tomm (actually whole week because of expiry) .

- Better to long positions based on oscilators signal (buy when RSI and Stocastics dip to oversold).

- BUY only above Pivot .

Disclamer : I hold a 4100 CA bought at 140 and it closed at 152 today . Looking to carry it further if its in profit , else i will sell it once Nifty hits below 4200 .

Continue Reading

May 24, 2009

Market View for Monday 25th May

Next week is Expiry week .

Markets have made spectacular moves this month after elections result and looks extremely overbought and bullish both . What does that mean ?

I am not saying markets may not go up more , there is no limit of insanity and emotional buying . But understand that this is the time to be extremely cautious . If you buy emotionally and put a big chunk and then market reverses back telling you that this was just a big rally in bear market . Your money will be stuck and you may take big losses .

Markets are consolidating and it resting before moving forward . Be patient and wait for the right opportunity to buy . This is from long term investing point of view . If you are short term trader with 1-2 days of time frame , what i just talked about may not be relevent for you .

Trade lightly this week because of expiry .

Pivot Levels for Monday 25th May

R2 4,308

R1 4,273

Pivot 4,215

S1 4,180

S2 4,121

Strategy for Monday

- Buy if markets open above Pivot levels .

- If markets open below pivot BUY only only when it reached support levels of 4160 .

- Better not to short now as it has already been in red for some days in this strong upmove .

- Have logical Stop losses .

- Control your losses .

- Dont prematurely book your profits thinking that you will loose what has already come to you .

Continue Reading

Markets have made spectacular moves this month after elections result and looks extremely overbought and bullish both . What does that mean ?

I am not saying markets may not go up more , there is no limit of insanity and emotional buying . But understand that this is the time to be extremely cautious . If you buy emotionally and put a big chunk and then market reverses back telling you that this was just a big rally in bear market . Your money will be stuck and you may take big losses .

Markets are consolidating and it resting before moving forward . Be patient and wait for the right opportunity to buy . This is from long term investing point of view . If you are short term trader with 1-2 days of time frame , what i just talked about may not be relevent for you .

Trade lightly this week because of expiry .

Pivot Levels for Monday 25th May

R2 4,308

R1 4,273

Pivot 4,215

S1 4,180

S2 4,121

Strategy for Monday

- Buy if markets open above Pivot levels .

- If markets open below pivot BUY only only when it reached support levels of 4160 .

- Better not to short now as it has already been in red for some days in this strong upmove .

- Have logical Stop losses .

- Control your losses .

- Dont prematurely book your profits thinking that you will loose what has already come to you .

Continue Reading

May 21, 2009

Market Update for Thursday , Mar 21

As I write this , DOW is 140 points down .

There is suddendly this bearish environment all over the place . Indian markets are down for last 3 days including today . We are near important support levels of 4170 now and breaking that would mean , bears coming back in the game for short to medium term .

We should not understand that we are in a bear market till now and may be markets have made its top for the rally . That is a possibility . But confirmation would come only after some days . Next week is expiry and that makes it more difficult to predict what can happen . Better to wait on side lines now till a clear trend emerges .

Nifty Pivot levels for Friday 21 may :

I expect market to open flat to a bit high and then move lower .

Continue Reading

There is suddendly this bearish environment all over the place . Indian markets are down for last 3 days including today . We are near important support levels of 4170 now and breaking that would mean , bears coming back in the game for short to medium term .

We should not understand that we are in a bear market till now and may be markets have made its top for the rally . That is a possibility . But confirmation would come only after some days . Next week is expiry and that makes it more difficult to predict what can happen . Better to wait on side lines now till a clear trend emerges .

Nifty Pivot levels for Friday 21 may :

R2 4,363

R1 4,287

Pivot 4,243

S1 4,167

S2 4,123

I expect market to open flat to a bit high and then move lower .

Continue Reading

May 20, 2009

20th May , Thursday call

What happened on Wed , 20 May

The over all trend is UP , and its strong !! . But correction can also not be ruled out , Markets are resting for some time only to move up again . So what should be strategy for tomm .

Pivot levels for Thursday are

R1 - 4341

Pivot - 4293

S1 - 4222

I expect Nifty to open flat to negative tomorrow , what should be the strategy tomm .

- If markets Open flat , then go with the direction after 10 min

- If markets open low near levels of 4200 , dont look for shorts then , look for Long opportunities

- If markets gap up in opening, then you must see other factors like current news , asian and european markets . Better to take shorts only for intra day and not carry them .

- If you are trading in options , better to go for In the money options and not out of money options . use 4000/4100 CA or 4500/4400 PA .

Continue Reading

- Profit booking

- Huge Volumes

- Close before the pivot of the day

- Choppy day

- Moving towards support of 4200 level .

The over all trend is UP , and its strong !! . But correction can also not be ruled out , Markets are resting for some time only to move up again . So what should be strategy for tomm .

Pivot levels for Thursday are

R1 - 4341

Pivot - 4293

S1 - 4222

I expect Nifty to open flat to negative tomorrow , what should be the strategy tomm .

- If markets Open flat , then go with the direction after 10 min

- If markets open low near levels of 4200 , dont look for shorts then , look for Long opportunities

- If markets gap up in opening, then you must see other factors like current news , asian and european markets . Better to take shorts only for intra day and not carry them .

- If you are trading in options , better to go for In the money options and not out of money options . use 4000/4100 CA or 4500/4400 PA .

Continue Reading

Are you a new or Struggling trader , read this chat

Below is a chat between me and a new and struggling trader . If you are also a new or struggling trader . Read the chat below .

Continue Reading

plugoo: [My Plugoo] [MAB] hi

manish_chn: hi

plugoo: [MAB] who is this

manish_chn: I am Manish Chauhan

manish_chn: owner of http://www.jagoinvestor.com

manish_chn: How are you doing

plugoo: [MAB] hi manish...i m a regular reader of jagoinv.

manish_chn: Great !! , how are you finding this posts

manish_chn: I hope they teach you something

manish_chn: What you name ? MAB ?

plugoo: [MAB] its really useful for me..even though i am a trader..i was rather ablind shooter..

plugoo: [MAB] Binoy MA...thas my name

manish_chn: ok

manish_chn: you should read my TA blog

manish_chn: I give some insight on markets there

manish_chn: anywyas .. jagoinv is also a must read for anyone

plugoo: [MAB] now i am trying to learn from ur writings..

manish_chn: great !!

manish_chn: don't buy or sell blindly

manish_chn: it takes years to understand how to make money consistently

manish_chn: stop and first learn a lot

manish_chn: may be for 1 yrs

plugoo: [MAB] yu r right...

manish_chn: yes

manish_chn: I have been trading for last 1 yrs and believe me , I am still struglling

manish_chn: I am still in loss

manish_chn: and still I can't make consistent money

manish_chn: I have learned a lot

manish_chn: and now I am improving

plugoo: [MAB] wht hapnd with me was ..i make some gud profit as a short term trader.

plugoo: [MAB] then i started day trading ..idont know whether i can term it day trading..its called intraday in indiabulls ...ur position will be squared of at around 3. or 3.10 automatically...

plugoo: [MAB] here i loss everything...

plugoo: [MAB] i made before..

manish_chn: hmmm

manish_chn: yea its called day trading

manish_chn: and its leveraged

manish_chn: you buy 100 by just paying 20

manish_chn: correct

plugoo: [MAB] even today also i played with icici....i bougth at 720..then it touched 731..then my greed told me to wait..then it dived to 700...n finally i book loss at 708..

manish_chn: hmm...

manish_chn: why did you buy ? today

manish_chn: I am sure you bought it because it went below 710 and then when it went upto 720 , you thought that its now moving up

manish_chn: and didn't want to be left out

plugoo: [MAB] so i m planning to stop day trading...its just blind shooting for me..i dont know any tech. analysis...from my observation i learned that icici is a very good price swinger..

manish_chn: and hence you bought , correct

plugoo: [MAB] ur absolutely correct

manish_chn: :) hehe

manish_chn: you know , it takes years to understand this thing

manish_chn: I will teach you this thing just now

manish_chn: and already remember it

manish_chn: you are not able to differentiate between volatility and actual price movement

manish_chn: keep saying "hmmm..." or "ok" so that I know that you are reading

plugoo: [MAB] yea ..whjt i think gud for me is delivery base buy..in cash..not intraday

plugoo: [MAB] wht do u think

plugoo: [MAB] ok

manish_chn: no

manish_chn: its not like that

manish_chn: may be yes , its not for you

plugoo: [MAB] then

manish_chn: but at this moment you are not succeeding becuause you are not doing it correctly

plugoo: [MAB] hmm

manish_chn: first you have to undetrstand what is day trading

manish_chn: and how is it done

manish_chn: what are important things for day trading

manish_chn: the first thing

manish_chn: did you know before markets opened , that what was the mood of market toay

manish_chn: and what was it expected to do ?

plugoo: [MAB] ok

plugoo: [MAB] yea

manish_chn: tell me

plugoo: [MAB] i look for previous days

manish_chn: what was the mood

plugoo: [MAB] us and EU markets

manish_chn: did you know that markets have gone so much up and profit booking is expected

plugoo: [MAB] EU was plus

manish_chn: and market mood for today was to book profit

plugoo: [MAB] yea manish..that inteligence also back fired on me..

manish_chn: one thing always understand

manish_chn: today icicibank was coming down

manish_chn: and you were buying

manish_chn: you were against the trend

manish_chn: trend was down (for today) and you are a day trader

manish_chn: so logically you have to ride the trend

manish_chn: so if its going down , sell .

manish_chn: if its going up , buy

plugoo: [MAB] post election when market went 2000+ i thought next day there will be a profit booking..hence next dat i short on icici..but to my sadness..i found that only icici was moving up

manish_chn: arre no

manish_chn: you are doing it totally wrong way

manish_chn: don't fight the trend

manish_chn: this is extremmelly important

plugoo: [MAB] really man...

manish_chn: you need to first stop

manish_chn: and take some break or vacation

manish_chn: because I guess currently you are so much exhayusted with all the losses and frustration

manish_chn: :)

plugoo: [MAB] wht ever i do in daytrading..it seems that market has eyes and it watches me an do what exactly opposite to it

manish_chn: happens with all

manish_chn: :))

manish_chn: same happens with everyopne

manish_chn: I can see myself in you :)

manish_chn: this all has happened with me too

manish_chn: and I have made some amazing losses

manish_chn: I have don't worst trading of all

manish_chn: done

plugoo: [MAB] so whts ur advice for me..

manish_chn: ok

manish_chn: how much have you losr

manish_chn: lost till now

plugoo: [MAB] in 3 months 26K

manish_chn: hmm

manish_chn: total = 26000

plugoo: [MAB] not much ha!

manish_chn: correct

plugoo: [MAB] no man..its huge for me

manish_chn: hmm.. ok

manish_chn: may be its huge

manish_chn: one thing is

manish_chn: you have tio understand that this is a place where you are trading against professionals and people who have decades of experience

manish_chn: so you have to accept that it has to be damn tough

manish_chn: making money from markets is not childs play

manish_chn: I am not talking about 1 or 2 day profit

manish_chn: I am talking about consistent profit

plugoo: [MAB] ok..

plugoo: [MAB] so should i stop..?

manish_chn: so , what do you want to do

manish_chn: are you doing it for time pass

manish_chn: or are you here to make some money and then leave

manish_chn: is it your side hobby kind of thing

manish_chn: if I ask you , do you seriously take it or take some effort for it , will your answer be "yes"

plugoo: [MAB] very much YES

manish_chn: ok

manish_chn: do you want to make a career out of it

manish_chn: like leaving your job and doing this seriously \

plugoo: [MAB] do u know form one of your atricles ..today i down loaded a study material on technical analysis..

manish_chn: or even if you don't leave your curretn job , will you do it as your business

manish_chn: ok am great

plugoo: [MAB] without leaving my job..but like a parellel job..

manish_chn: Binoy , I am sure that you understand that you have to work hard and learn

manish_chn: but I thikn you still underestimate the effort you have to put here

manish_chn: have you read some books

manish_chn: what do you know about technical analysis

manish_chn: or physcology of trading

plugoo: [MAB] "0"

manish_chn: hmm.. see, and you say that you are serious

manish_chn: may be your are serious mentally , but not from your actions

manish_chn: first stop trading for time being

manish_chn: and learn

manish_chn: becoming trader is just like becoming a doctor or pilot or engineer

plugoo: [MAB] hmm

manish_chn: you have to do the course

manish_chn: and that you have to do your self

manish_chn: and give time to it

manish_chn: it may look vert easy , because its only BUY or SELL

manish_chn: but you have seen , how difficult it is

plugoo: [MAB] yea..i have seen it

manish_chn: I am sure you will have some fundamental problems

manish_chn: like

plugoo: [MAB] let me tell u one thing...

manish_chn: You keep your looses going on and hoping that they will come back

plugoo: [MAB] ok tell me..sory to interupt

plugoo: [MAB] yea..

manish_chn: yeah , tell me

plugoo: [MAB] i am doing trading for the last 1 year...i started when market was around 18K+

manish_chn: k

plugoo: [MAB] i sit with experts in front of the trading terminal in the Arcadia ...

plugoo: [MAB] there i make some gud profit some arnd 20K

manish_chn: where do you work ?

manish_chn: what's arcadia

plugoo: [MAB] Arcadia is like Indiabulls, geojit..sherkhan..a brocker firm..so they had the realtime terminal..

manish_chn: who are these experts you are talking about

plugoo: [MAB] n they daily get gud tips..an almost all of it will work..so i made profit there..

plugoo: [MAB] then leave them ..started my own in indiabulls online trading without getting any tips n hints..

plugoo: [MAB] now i started to be in loss...

plugoo: [MAB] just one month back only i came acroos ur jago invester

manish_chn: hmmm

plugoo: [MAB] then only i take learning in trading dseriously..

manish_chn: hmm..see , first thing is it's a good thing not to be dependent on some one tips

plugoo: [MAB] i gone through all ur blogs soince 2009 jan..i copied to all those relate to trading into my harddisk ...

manish_chn: and they will stop working some day

plugoo: [MAB] so my point is ..i have just started lerning..

plugoo: [MAB] now u may continue..i m listening

manish_chn: ok , I got your point

manish_chn: see , if you want to become a trader and learn things your self

manish_chn: its a very tough path

manish_chn: but its achaievable

plugoo: [MAB] oh..

manish_chn: what ohh

plugoo: [MAB] tough pah..made me oh..

manish_chn: not only tough , but extremmly tough

manish_chn: I mean , to become a good trader

manish_chn: who makes money consistently

plugoo: [MAB] ...but i think i can...

manish_chn: yes , why not

manish_chn: you can

manish_chn: I can

manish_chn: any one can

manish_chn: who is ready to do it

manish_chn: :)

manish_chn: so learn trading first

plugoo: [MAB] wht i hv to do it for that..stay away frommarket n..learn n come back after some time?

manish_chn: and believe me , you have to give atleast 1 yr

manish_chn: no

manish_chn: be with the market , but don't trade

manish_chn: don't trade real money

manish_chn: trade on paper

manish_chn: note down when you buy and when you sell

manish_chn: make your notes of trae

manish_chn: trade

manish_chn: have you made notes of your trades

manish_chn: ?

manish_chn: what is your average loss per trade

plugoo: [MAB] thats a gud sugg..but the problem is in paper when u make money..may feel sory that its not the real one..

manish_chn: yes

manish_chn: this is one big problen

manish_chn: but why didn't you tell me that one good thing about paper trading is tat when oyu loose money on paper you are happy that it was not real

plugoo: [MAB] in day trade..i make an avg loss of 1000+ or - per day

manish_chn: this is psychological

plugoo: [MAB] but profit is avg 400,500 etc

manish_chn: which city are you in ?

plugoo: [MAB] i m from kerala..

plugoo: [MAB] now at kuwait

manish_chn: ok , if you were in bangalore , I could have coached you

plugoo: [MAB] hmm

manish_chn: anyways

manish_chn: so first learn for some time . read books

manish_chn: see the markets

manish_chn: try to learn some technical analysis

manish_chn: do you read sudarshan shukani

manish_chn: or breet steenbarger ?

plugoo: [MAB] but u said in ur blog tech. anlss is just 10%

plugoo: [MAB] but can;t be avoided hah?

manish_chn: yes

manish_chn: I mean ... it's a tool

manish_chn: you better have it withy oyu

plugoo: [MAB] hmm

manish_chn: let me ask you simple

manish_chn: q

manish_chn: if you buy some thing at 720

manish_chn: and it starts to go down

plugoo: [MAB] ok

manish_chn: say 715

manish_chn: what do you say to your self

plugoo: [MAB] it will come back n bring u to profit

manish_chn: yes

manish_chn: and may times it happens

plugoo: [MAB] n more time the other way arnd

manish_chn: so you must say that I know that it will go down to may be 680 but eventually it will come back and give me profits

manish_chn: and some times you know that it will really go to 680

manish_chn: correct

manish_chn: with high probability

plugoo: [MAB] hmm

manish_chn: so why don't you then sell at 715 and then wait for it go go more down and then buy it back at that levels

plugoo: [MAB] u mean to say there i need tech . anlss

manish_chn: the most important element which is missing in your trading is "no control on losseS"

plugoo: [MAB] ur right

manish_chn: I will tell you simple thing

manish_chn: if you trade 10 times

manish_chn: how many times will you loose

manish_chn: ?

manish_chn: around 5 times

manish_chn: even if you are a bad trader sometime you aer lucky and you make priofits half times

plugoo: [MAB] yea

manish_chn: so say your equity is 1 lacs

manish_chn: and you make 10 trades

manish_chn: each time you say that I will take max loss of 600 or 700

manish_chn: not more than that

manish_chn: evn if you loose all 10 times

manish_chn: you will loose 7-8k

manish_chn: out of 1 lac

manish_chn: that's 7-8% loss

manish_chn: if you control all your losses

manish_chn: what I am trying to say is losses are like wounds on body

plugoo: [MAB] yea..sounds intersting

manish_chn: if you take care of it in early stage

manish_chn: and don't let it grow

manish_chn: you can take a lot of them

manish_chn: and still you will be healthy

manish_chn: and it won't pain

manish_chn: but if you leave even one or 2 wounds open and don't take care of it

manish_chn: it can kill you

manish_chn: its not looses which are your enemies

manish_chn: its uncontrolled losses

manish_chn: losses which you allow to grow

manish_chn: loss comes , cut it

manish_chn: loss comes , cut it

manish_chn: loss comes , cut it

plugoo: [MAB] hmmm

plugoo: [MAB] gud read

manish_chn: then

manish_chn: profit comes , wait for it to grow

manish_chn: I know the temptation to take the profit

manish_chn: you are so worried that it will go away

manish_chn: its psychological

manish_chn: its in your mind

manish_chn: prices don't know that you are thinking that it will come down

plugoo: [MAB] even if it was known the expectation that it it will come to ur profit region prevents from booking loss

manish_chn: you know, your total mind thinking and attitute towards trading needs a change

manish_chn: you need to look it in a fresh way

manish_chn: have a new start

manish_chn: if you succeed in trading , you can make all the money in 3-4 yrs , what you want to make in your life

manish_chn: I mean you can make excellent money

manish_chn: that's enough motivation to try this

plugoo: [MAB] i think like saying 'no' is the must lernt thing inlife..in market booking profit is the basic thing is in market

manish_chn: :)

manish_chn: controling losses and letting your profits run is the key

manish_chn: one last thing ..

manish_chn: understand volatility and actual trend

manish_chn: when prices start going up , do you think that prices are not reversiing

manish_chn: ?

plugoo: [MAB] hmm..

manish_chn: when prices are declining

manish_chn: obviously in betwwen , it will also go up

plugoo: [MAB] so?

manish_chn: there are many people who want to take thjere profits

manish_chn: so you have to understand that it is a correction in a downtrend

manish_chn: like today

manish_chn: with your ICICI

manish_chn: the time when you biought , it was actually a time to sell

plugoo: [MAB] hmmm..

manish_chn: it was an opportunity to sell so that you can take 12 point profit

manish_chn: http://in.finance.yahoo.com/q/ta?s=ICICIBANK.NS&t=5d&l=on&z=l&q=l&p=e50,e200&a=m26-12-9,r14,ss&c=

manish_chn: see this

manish_chn: see the green line

manish_chn: tthats 200 MIn ema

manish_chn: that's the average price over 200 min

manish_chn: noe that's down

manish_chn: not even a single time in a day it was moving up

manish_chn: its direction is only down

manish_chn: that shows that the trend is down andhence bearish

plugoo: [MAB] my god..

manish_chn: any up move should be treaded as opportunity to sell again

manish_chn: :)

plugoo: [MAB] hmmm..

manish_chn: I know you must be thinking that its so obvious , why didn't you see it

manish_chn: but its too tough ..

manish_chn: poeople can't see obviuos things

plugoo: [MAB] so whts ur tip to me as day trader..

manish_chn: first unjderstand , that are you a day trader ?

manish_chn: are you really a day trader

manish_chn: do you have time for it

plugoo: [MAB] :(

manish_chn: or would you like to be a position trader

manish_chn: who buys today and sells after 2 days

manish_chn: or 5 days

manish_chn: or 10 days

plugoo: [MAB] yea...

plugoo: [MAB] position trader is i m better explained i think

manish_chn: see

manish_chn: you are doing wrong thing from te start then

manish_chn: you have married a trading way which you are not comfortable it

manish_chn: better to divorce

plugoo: [MAB] i will if i hsve to

manish_chn: and start to understand this new way you are comfortabl with

manish_chn: :)

plugoo: [MAB] new way..position trader?..

manish_chn: hmm

manish_chn: yes

manish_chn: so stop for some time , better go away for some time

manish_chn: not come back until 1 month

manish_chn: to market

plugoo: [MAB] ok

plugoo: [MAB] .....

manish_chn: and then learn

manish_chn: practice

manish_chn: and read some good people

manish_chn: like Breet

plugoo: [MAB] like u hah? :)

manish_chn: traderfeed.blogspot.com

manish_chn: how do you find me

manish_chn: ?

manish_chn: am I a good motivator

manish_chn: ?

plugoo: [MAB] u really r!!!

manish_chn: :)

manish_chn: thanks

manish_chn: but its extremmelly tough to follow things ourselves

manish_chn: I still do mistakes , but I learn from them

plugoo: [MAB] hmm..

manish_chn: and have confidence

manish_chn: don't loose heart

plugoo: [MAB] can i add u to my google talk if u dont mind if u have a gmail id

manish_chn: if you start making losses again or its tough

manish_chn: manish.pucsd@gmail.com

manish_chn: manish_chn@yahoo.com

manish_chn: talk to me anytime you need help

plugoo: [MAB] ok..

manish_chn: go to my shelfari page

manish_chn: and see all the books I have read

manish_chn: on trading

manish_chn: read those

plugoo: [MAB] ur my motivator , teacher since one month..n friend from today ..ok..

manish_chn: :)

manish_chn: sure ...

manish_chn: talk to other traders

manish_chn: know how they think

manish_chn: learn and teach

plugoo: [MAB] ok..

manish_chn: spread knowledge

plugoo: [MAB] sure..

manish_chn: so

manish_chn: one thing

manish_chn: do this

plugoo: [MAB] u r a full time trader..i mean ur job

manish_chn: nah man

manish_chn: I am a software eng

manish_chn: and I want to make acareer in trading

manish_chn: I trade part time

plugoo: [MAB] part time means...how often

manish_chn: and I am still a failure but not I am very close to success

manish_chn: I think that

manish_chn: now

manish_chn: now I have learned things

plugoo: [MAB] whts ur trading pattern

manish_chn: and from past some month things are in contrl

manish_chn: I trade options

manish_chn: not stocks

manish_chn: and one thing .. don't get into derivatives in start

manish_chn: no futures or opionns for some tne

manish_chn: once yu can trade stocks , then think about derivatives

plugoo: [MAB] ok..

manish_chn: so if ICICI opns stronger tomm

manish_chn: and starts moving up

manish_chn: then BUY

manish_chn: and sit tight

manish_chn: and don't involve your emotions in your decisions

manish_chn: buy , and keep some stop loss and leave ]

manish_chn: I know you keep looking at your screen every 20 sec :)

manish_chn: correct :)

plugoo: [MAB] :)

plugoo: [MAB] mazbooth

manish_chn: what?

plugoo: [MAB] really

manish_chn: and the moment prices go rs 1 below your buy , you seem to feel bad and think "should I sell"

manish_chn: you just want it to go up only

manish_chn: and never down

plugoo: [MAB] i read that u really enjoy options..still i hv no idea abt options.n fututre..i hv downloaded ur article..not get time till to read it..

manish_chn: hmmm

manish_chn: ok

manish_chn: but for now , don't get into it

manish_chn: ekse it will become comples

manish_chn: be with stock trading for now

manish_chn: and get into derivatives later

plugoo: [MAB] ok..i will not

manish_chn: just to let you know and make you greedy

manish_chn: icici options yesterday were at 4

manish_chn: and by end it was at 40

plugoo: [MAB] is the stock trading is inferior to options n futures

manish_chn: so 10k invested at 4 was rs 1 lac after some hrs , same day

plugoo: [MAB] hmmm

manish_chn: that happes in options

manish_chn: but don't tink abut it

manish_chn: its too risky

manish_chn: if you invest 10k in stocks and loose 500 in it

manish_chn: in opiotns its can be 10k investment and 9k loss the same day

manish_chn: or 10k loss

plugoo: [MAB] oops!!..

manish_chn: some times in 5 min

plugoo: [MAB] hmm.

manish_chn: so stay away .. trade stocks for now

plugoo: [MAB] so u dont trade in stock...

manish_chn: no , I don't trade in stocks

plugoo: [MAB] hmm

manish_chn: I trade optons

manish_chn: bcause I started with options only in market

manish_chn: and that was a huge mistake

manish_chn: but now I have learned so much that now I can afford to keep trading in options and learning

plugoo: [MAB] u didnt trade stocks at all?

manish_chn: nah .. just once or twice

manish_chn: but that too was in loss only

manish_chn: but first stock trade and first option trade was in profit

manish_chn: :)

manish_chn: and that increased my belief that "I am becoming a millionaire next year" , trading is easy

manish_chn: far from truth :_)

plugoo: [MAB] is the stock trading is inferior to options n futures

manish_chn: what is the meaning of inferior ?

manish_chn: what do you say inferior

manish_chn: ?

manish_chn: stocks tradig is less complicated , less rewarding and most importantly "extremmely less RISKY"

plugoo: [MAB] its like...is there anythink like..biggies, n experts only do options n futures..stock is for small ppl..something like that?

manish_chn: nah

manish_chn: nothing like that

manish_chn: most people trade stock only

manish_chn: options are mainly hedging tools and some advanced pepoep trade them

manish_chn: but its not easy at all

manish_chn: its all about your risk appeitite

plugoo: [MAB] hmm

manish_chn: if you want to make 10k by invest 5k in 2 days , but you are ready to loose it all

manish_chn: then go trade options

plugoo: [MAB] i c

manish_chn: take it from me , don't get into optiosn soon

manish_chn: trade stocks and be happy

manish_chn: options will come later

plugoo: [MAB] not at all..

plugoo: [MAB] i humble target is 500 rs per day..

manish_chn: what is your trading capital

plugoo: [MAB] 50K

manish_chn: grreat

manish_chn: then its posisible

manish_chn: how much do you put in one go

manish_chn: how much is your capital in market at one time

manish_chn: what are your moneymanagemetn rules

plugoo: [MAB] :)..no rules yaar...total anarchy..

plugoo: [MAB] i m familiar with some stocks..like icici,unitech,rnrrl,rpl,sbi, ivrl prime..etc..i so i just buy on dips...to an extent of 40K total..

manish_chn: no !!

manish_chn: see , you are making mistake again here

manish_chn: you are putting a lot of your money at one point

manish_chn: 50k is your capital

plugoo: [MAB] right

manish_chn: don't put more than 10k at one time

manish_chn: and be consisent eith it

plugoo: [MAB] !!! r u sure

manish_chn: yes

manish_chn: no more than 15k max

manish_chn: you do day trade , correct

manish_chn: so you are using leverage

manish_chn: you can buy 50k worht of stocks with 10k

manish_chn: correct

manish_chn: ?>

manish_chn: do you use margin

plugoo: [MAB] hmm

manish_chn: yes or no

plugoo: [MAB] margin...i dont know..

manish_chn: ok , so when you put a trade

manish_chn: why you buy

manish_chn: when you buy something

manish_chn: there is an ioption if you want to buy on margin or not

manish_chn: so you give just 20 and you will get 100 worth

plugoo: [MAB] whts that

manish_chn: see margin trading

manish_chn: see , you don't have any knowledge of basics and you are doing one of the toughest things in world , i.e "Day Trading"

manish_chn: you are not prepared

manish_chn: better you read some good books first

manish_chn: :)

plugoo: [MAB] yea i m not...

manish_chn: sorry to be straight forward

manish_chn: but I talk staright :)

plugoo: [MAB] i like it that way..

manish_chn: ok

plugoo: [MAB] ur welcome

manish_chn: so you are not prepared and the worst tihng is you didn't know it :)

manish_chn: so go back and come after preparation

manish_chn: read timamo , sudarshan sukahni and breet

plugoo: [MAB] so to get the abcd of trading..what i should read first

plugoo: [MAB] first

manish_chn: first go and read breet stenbarger

manish_chn: his articles

plugoo: [MAB] ok...

plugoo: [MAB] i mad u waste ur valued time..

manish_chn: http://traderfeed.blogspot.com/2006/04/ten-lessons-i-have-learned-from.html

manish_chn: he writes a lot fof articles on general wisdom

manish_chn: see his archives

manish_chn: look at posts which related to you and ignore the technical ones

manish_chn: posts like these

manish_chn: http://traderfeed.blogspot.com/2006/04/ten-lessons-i-have-learned-from.html

plugoo: [MAB] sure...thks for that...

manish_chn: and read timamo.blogspot.com

manish_chn: and read me too ;)

manish_chn: but they are the best ... I am just puttng somr random thoughts

manish_chn: :)

plugoo: [MAB] i tried that from the link u provided in ur blog..its lil boring..timamo

manish_chn: why ?

manish_chn: he puts so many graphs and things

manish_chn: may be you can ignore him for time being

manish_chn: you first get basics

manish_chn: explore

manish_chn: :)

manish_chn: make a lot of mistakes yourself

plugoo: [MAB] yea..i m just a beginner n i need basics

manish_chn: that's the best source of learning

plugoo: [MAB] :)

manish_chn: else its very tough to learn from here anf there

manish_chn: :)

manish_chn: make notes for each trade

manish_chn: and see it later , what you did wrong

plugoo: [MAB] hmm...

manish_chn: I have all the trades from last 5-6 months

manish_chn: with charts and all the data

manish_chn: my trades

manish_chn: and I am consistent :)

manish_chn: consistent in making LOSSS :))

manish_chn: =))

plugoo: [MAB] consistency is the key

plugoo: [MAB] :)

manish_chn: but that will change :)

plugoo: [MAB] as beginner do u think breet stenbarger;s read are gud for me..

manish_chn: yes

manish_chn: I am not talking about his technical posts

plugoo: [MAB] ok.gud

manish_chn: which talk on markets

manish_chn: see his posts which talk about general things

manish_chn: like the post I gave you

plugoo: [MAB] hmmm

manish_chn: you will have to go through each of them

plugoo: [MAB] i understand..

manish_chn: and start reading it and decide if it will help you or not

manish_chn: see all his archives

manish_chn: Can I put this chat on my blog

plugoo: [MAB] ok..

manish_chn: not on jagoinvestor

manish_chn: but my TA blog

manish_chn: it help help others like you to leant

manish_chn: learn

manish_chn: I hope that's fine with you

plugoo: [MAB] not an issue..but who need this ..

manish_chn: hehe .. everyone is like you

manish_chn: I mean most of them

manish_chn: you are not alone :)

manish_chn: many people will read

manish_chn: infact I also learnt some things myself here :)

plugoo: [MAB] ok then now no probs..its my ppleasure...

manish_chn: ok thanks'

Continue Reading

Subscribe to:

Posts (Atom)