- US markets ended Lower

- SGX Nifty down

- Indian Markets were up from so many weeks and were looking tired and closed lower in last 2 days .

What does that mean ? SELL on small upbounce with tight stop losses . No great analysis needed here . Just short !! .

Continue Reading

June 15, 2009

June 14, 2009

Wait for BUY , Sell on pullbacks

The Pivot for nifty today is around 4535 . SGX Nifty is trading about those levels and India Markets are also expected to go lower today as other Asian markets are also trading lower .

Nifty seems to be tired now and it would be a healthy for it , if it corrects itself now , otherwise it will become more vulnerable for a big and sudden fall later .

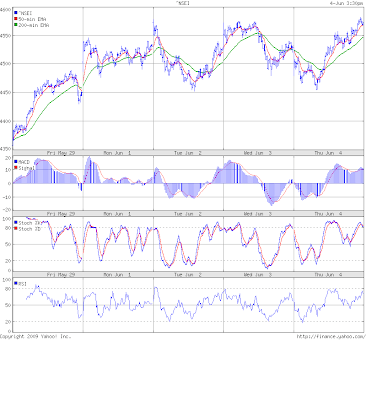

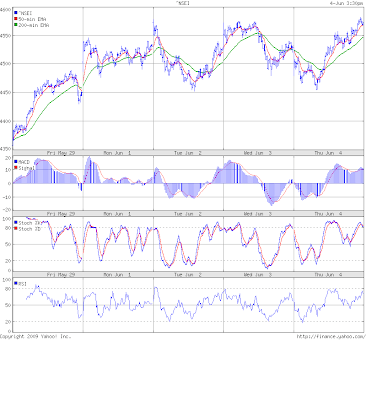

If you see 9 months chart , ADX seems to be falling now from many days indicating that its tired now and the momentum is declining .

If you are looking for buying , wait for short term . If you want to short , do it on pullback on intra-day .

Continue Reading

Nifty seems to be tired now and it would be a healthy for it , if it corrects itself now , otherwise it will become more vulnerable for a big and sudden fall later .

If you see 9 months chart , ADX seems to be falling now from many days indicating that its tired now and the momentum is declining .

If you are looking for buying , wait for short term . If you want to short , do it on pullback on intra-day .

Continue Reading

June 4, 2009

Markets near strong resistance , Call for Friday June 5

Markets went down today in the start and then bouced back . A small positive divergence was visible on MACD and RSI . It was worth taking a long shot because the prices were near the low of 2 days and hence a bounce back was expected .

Markets rallied then and didnt stop .. It closed near days high and at very important and strong resistance levels of 4570 levels . I am personally not very bullish , but i will change my mind if markets show me that i am wrong .

Markets rallied then and didnt stop .. It closed near days high and at very important and strong resistance levels of 4570 levels . I am personally not very bullish , but i will change my mind if markets show me that i am wrong .

Better to make long positions only if markets move above 4600 and buy on a small 20-25 points dip on intra-day level . Go short if markets start moving down from here with tight stop losses .

Continue Reading

Markets rallied then and didnt stop .. It closed near days high and at very important and strong resistance levels of 4570 levels . I am personally not very bullish , but i will change my mind if markets show me that i am wrong .

Markets rallied then and didnt stop .. It closed near days high and at very important and strong resistance levels of 4570 levels . I am personally not very bullish , but i will change my mind if markets show me that i am wrong .Better to make long positions only if markets move above 4600 and buy on a small 20-25 points dip on intra-day level . Go short if markets start moving down from here with tight stop losses .

Continue Reading

June 2, 2009

Market update 3rd June Wednesday

US markets are up marginally and SGX nifty is also up . we are near very important resistance level now . Momentum Can take this rally to 5000 levels or the correction can take it to 4000 levels again where it can again be a good buy for long term investors . NIFTY PE stands at 21 which is the main discouragement for long term investors

S2 4385.85

S1 4455.5

Pivot *4520.95*

R1 4590.55

R2 4656

What can be done now ?

I believe that trades should be taken on trend basis now , dont fall in that trap of catching the top of bottom and get maximum out of markets , better to go with it .

Buy when 50 EMA crosses above 200 EMA and sell otherwise .

Continue Reading

S2 4385.85

S1 4455.5

Pivot *4520.95*

R1 4590.55

R2 4656

What can be done now ?

I believe that trades should be taken on trend basis now , dont fall in that trap of catching the top of bottom and get maximum out of markets , better to go with it .

Buy when 50 EMA crosses above 200 EMA and sell otherwise .

Continue Reading

Subscribe to:

Posts (Atom)